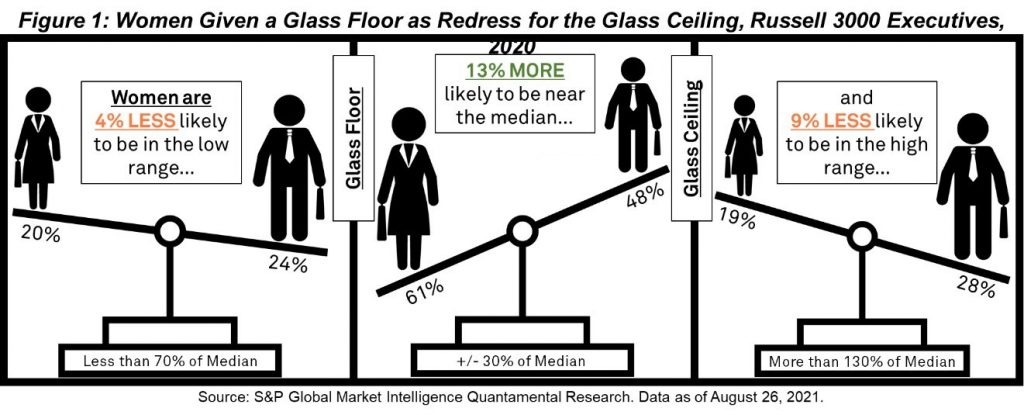

S&P Global released a first-of-its-kind research report analyzing the gender wage gap and its evolution over the last 15 years. The new report is titled “Glass Floors and Ceilings: Why Closing the Median Wage Gap Isn’t Fair“. It found that compared to men, women in executive roles are more likely to receive compensation in a compressed range around the median of their peer group (Figure 1). Firms have been focused on median compensation, but the high end of the compensation range can be much farther from the median than the low end. As a result, there has been a net disadvantage for women’s pay equity.

“In their push to address pay equity, companies have focused on one statistic – median pay – while losing sight of the larger picture. This suggests that companies are focused on the optics of the problem, rather than solving the problem,” said Daniel J. Sandberg, Senior Director of Quantamental Research at S&P Global Market Intelligence, who authored the report. “We hope this research sheds light on a worrisome trend and helps firms reevaluate their approach to closing the gender pay gap.”

Key findings

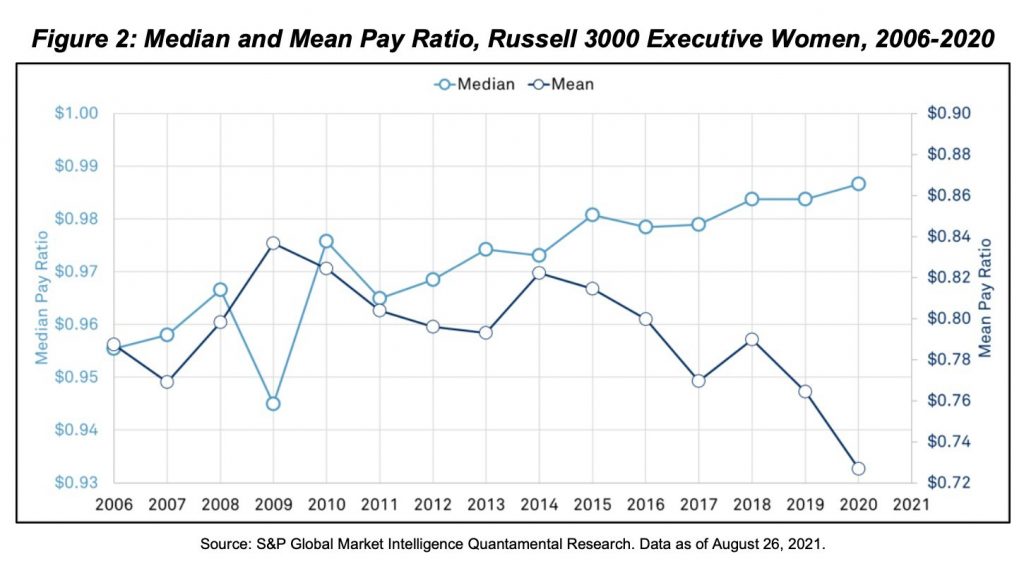

- Women’s median pay ratio has been steadily increasing over the 15-year study period. However, the mean pay ratio has been declining over most of that period. Above all, this suggests that measures of central tendency, used in many other studies, may be producing misleading conclusions by oversimplifying the gender wage gap problem to a single data point (Figure 2).

- Firms that have been defendants in federal court cases involving compensation disputes, discrimination, fraud or other governance-related affairs exhibit more pronounced Gender-Based Compensation Management (GBCM). The practice of GBCM artificially addresses the gender pay gap by increasing the median woman’s compensation. However, it does not provide women equal access to the full range of compensation. The findings suggest GBCM is associated with poor governance.

- The percentage of women holding positions across the C-suite, board of directors and executive levels was 15.4 percent in 2018. It grew to 19.2 percent in 2020. This progress is statistically meaningful. However, at this rate women have at least one to two more decades before they reach parity in their representation across senior roles. In positions where women’s progress has been slower, such as CEO, parity will likely take even longer.

“This report, along with our previous research around the benefits of greater women’s workforce participation, is more than just data on a page – it has the power to create real change,” said Dimitra Manis, Chief Purpose Officer at S&P Global. “I’m proud that we are not only advancing the conversation around the gender pay gap through new insights, but also committed to transparency around our own rewards structure to ensure equitable pay among our people.”

The positive impact of women leaders

This research was conducted by the S&P Global Market Intelligence Quantamental Research Team. It includes analyses of more than 80,000 executives who held positions at Russell 3000 firms during the years 2006-2020.

These findings build off the team’s previous research around the performance of companies with women in CEO and CFO positions. That research found that appointments of women leaders drove positive performance, including higher profitability and superior stock prices. Both reports are part of S&P Global’s #ChangePays initiative. The initiative illuminates the positive impact of women in the workforce across companies, organizations, economies and global communities.

Read the full report here.

About S&P Global

S&P Global is the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets. It offers ESG solutions, deep data and insights on critical business factors. We’ve been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. Our divisions include S&P Global Ratings, S&P Global Market Intelligence, S&P Dow Jones Indices and S&P Global Platts. For more information, visit www.spglobal.com.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global. S&P Global is the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets. It offers ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Add Comment