Book reviews for entrepreneurs who just want to know the best parts of the best books to grow their startup

What This Book Is About

You’re an entrepreneur with a great idea. But your business needs money. So, do you max out your credit cards, borrow from friends and family, and do everything yourself? Or do you make a devil’s bargain with some venture capitalist who’ll demand a tenfold return and could easily take your business out from under you?

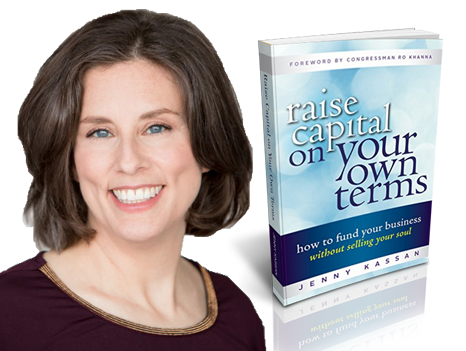

No and no! You don’t have to bootstrap, and you don’t have to sell out! In “Raise Capital On Your Own Terms: How To Fund Your Business Without Selling Your Soul,” Jenny Kassan says the landscape of investment capital is far larger and more diverse than most people realize. She illuminates the vast range of capital-raising strategies available to mission-driven entrepreneurs and provides a six-step process for finding and enlisting investors who are a match with your personal goals and aspirations. The plan you create will inspire you, excite you, and help you achieve your dreams.

Topics explored in Raise Capital On Your Own Terms include:

- Part I: Setting the Stage

- Chapter 1: Busting the Myths – Forget Everything You Think You Know

- Chapter 2: Are You Ready?

- Chapter 3: The Legal Framework – What Your Lawyer Probably Won’t Tell You

- Part II: Create Your Customized Capital Raising Plan

- Step 1: Get clear on your goals and values

- Step 2: Identify the right investors for you

- Step 3: Design your offer

- Step 4: Choose your legal compliance strategy

- Step 5. Enroll investors

- Step 6: Address obstacles head on

- Conclusion: Pulling it all together – your go-to market plan

Why You Should Read It

If you left it up to popular opinion, you startup isn’t valuable or validated until you receive venture capital, and real entrepreneurs know this is not the case. There are a variety of ways to raise money. While venture capital is a viable way to scale fast and have a large exit, knowing which type of funding structure is best for you in the long run is invaluable.

This book gives you the best way to get your hands on capital that makes the MOST SENSE for YOUR business. Kassan breaks it down in easy-to-understand language using logic and her years of expertise.

Best Takeaway

“Only approach those whose investment strategies and goals are in alignment with your trajectory and vision.”

Skip To Page

Page 207-223.

Get deep down into assessing if you are ready to raise capital. Then, use Kassan’s brilliant capital raising decision tool to get to the meat of what you need.

Add Comment