OAKLAND, Calif. — Crowdfund Main Street is putting the power of raising capital in the hands of founders. Raising money is often an exercise in patience for entrepreneurs whose investment terms are usually dictated by investors. At Crowdfund Main Street, average citizens now have the opportunity to invest in companies they care about with entrepreneurs who are looking for alternative ways to raise funds but remain in control of their enterprises.

“We have 1.2 million businesses get started in the U.S. and the VCs fund about 8,000,” Crowdfund Main Street Cofounder and CEO Michelle Thimesch said. “When you go to a VC, they’re handing you a term sheet. They are telling you the terms of their participation. We flipped that on its head and we have entrepreneurs go through their own numbers and projections. Do they care about who [they] sell to? I’m going to make an offer to investors and here’s my strategy,” Thimesch explained. “We allow entrepreneurs to be creative and say what would an investment in my company look like. Maybe you want to give up equity but no control.”

Thimesch, an estate and succession planning attorney, was practicing law in 2012 when the Jobs Act was passed which included rules to permit companies to offer and sell securities through Regulation Crowdfunding. It would take four years for the Securities and Exchange Commission (SEC) to adopt Title III Crowdfunding rules and on May 16, 2016, it became legal. Title III Crowdfunding allows non-accredited investors with less than $1 million in net worth to invest in businesses online and gain equity shares in companies.

Thimesch said she was excited about the new opportunities Title III Crowdfunding presented to business owners and asked around to see if anyone had more details on it. Someone referred her to Jenny Kassan, an appointee to the SEC Advisory Committee on Small and Emerging Companies who was also responsible for submitting the petition to the SEC that led to the passage of the 2012 JOBS Act.

“She came to my office and I said you’re going to think I’m crazy. [But], I have an idea for this,” Thimesch recalled.

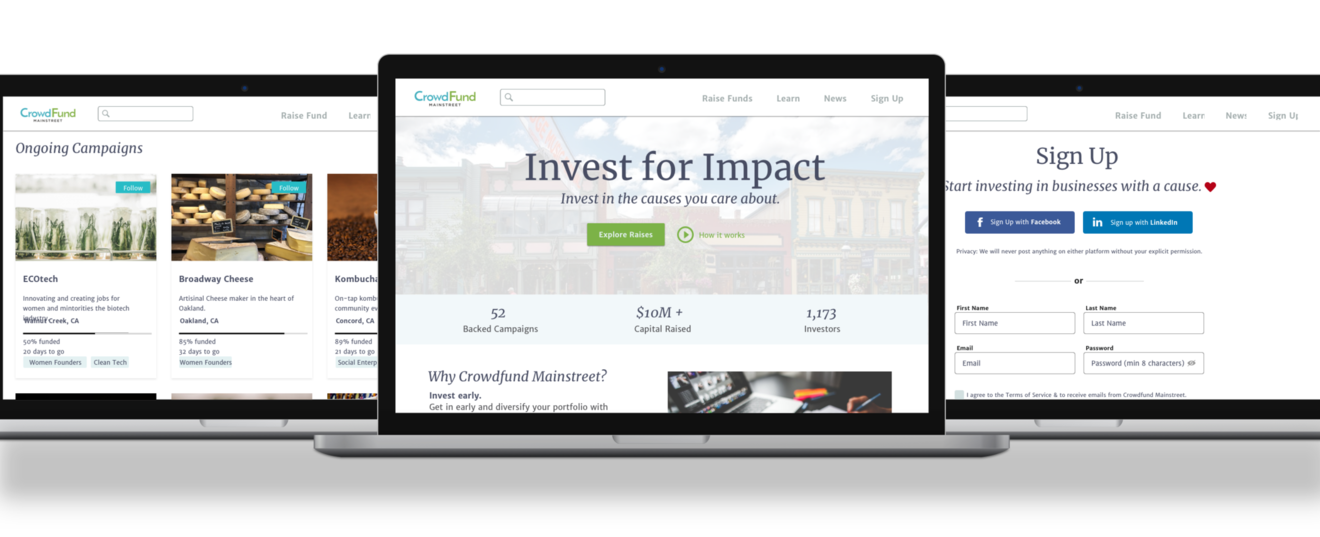

The two women hit it off and in August 2018, Crowdfund Main Street, an investment crowdfunding platform that connects mission-driven companies in the U.S. with impact-minded investors, launched with five Oakland-based businesses. Its cofounders said to understand the impact of investing in small businesses and startups, “consider that only $43 per $100 spent at national chains stays in a local economy, contrasted with $68 per $100 spent on local businesses. This $25 difference in spending per $100 in community contribution between local and national business chains means: the difference between living wage and minimum wage jobs; reduced access to quality professionals, such as teachers and firefighters; the loss of half the contributions to local charitable causes; increased energy and environmental costs for greater transportation needs and more.”

Since Title III Crowdfunding is still fairly new, Thimesch and Kassan said educating first-time investors is a large part of their process. “We believe over time the platform will be more successful because we’ll have people be prepared. We want to legitimize this ecosystem,” she said. “We’re not just dipping our toe in an ecosystem, we’re creating one. It’s a highly regulated, learning curve.”

In order to make sure businesses on Crowdfund Main Street are truly mission-driven, there are an extended application and interview process. If approved, the entrepreneur creates their investment terms and sets up a profile and fundraising campaign, similar to Kickstarter. A potential investor can peruse the platform for investment opportunities and if interested, click the Invest button and go through the process. Thimesch said they actually sign the investment agreement and have up to 48 hours before the close. The money sits in escrow. If the entrepreneur reaches their minimum fundraising goal, they receive the money.

“The process is all online, all very simple. Once closed, you get the countersigned document,” Thimesch said.

For now, she said, “We want to demonstrate the power of this tool. The goal is to get the community engaged. The sky is kind of the limit on this. The goal is to get Oakland to step up to the plate and show the rest of country this is viable.”

Add Comment