The annual Biz2Credit Women-Owned Business Study found that although revenues dropped for women-owned firms in 2020, their earnings grew. This is primarily because expenses decreased during the pandemic.

Women-owned business earnings in 2020 averaged $330,226, higher than in 2019. But they are still $421,928 less than the average for male-owned firms ($716,842) in 2020. The analysis also revealed that while the average credit score (597) for a female business owner increased from 590 last year, it was still 23 points lower than the average score of a male business owner (620) in the study.

The Biz2Credit study reviews 40,0000 credit inquiries from across the country for the full prior year (2020). It also examined the financial performance of women-owned small- to mid-sized companies in the United States. Despite austerity imposed by the COVID-19 pandemic many women owned businesses continue to find growth opportunities.

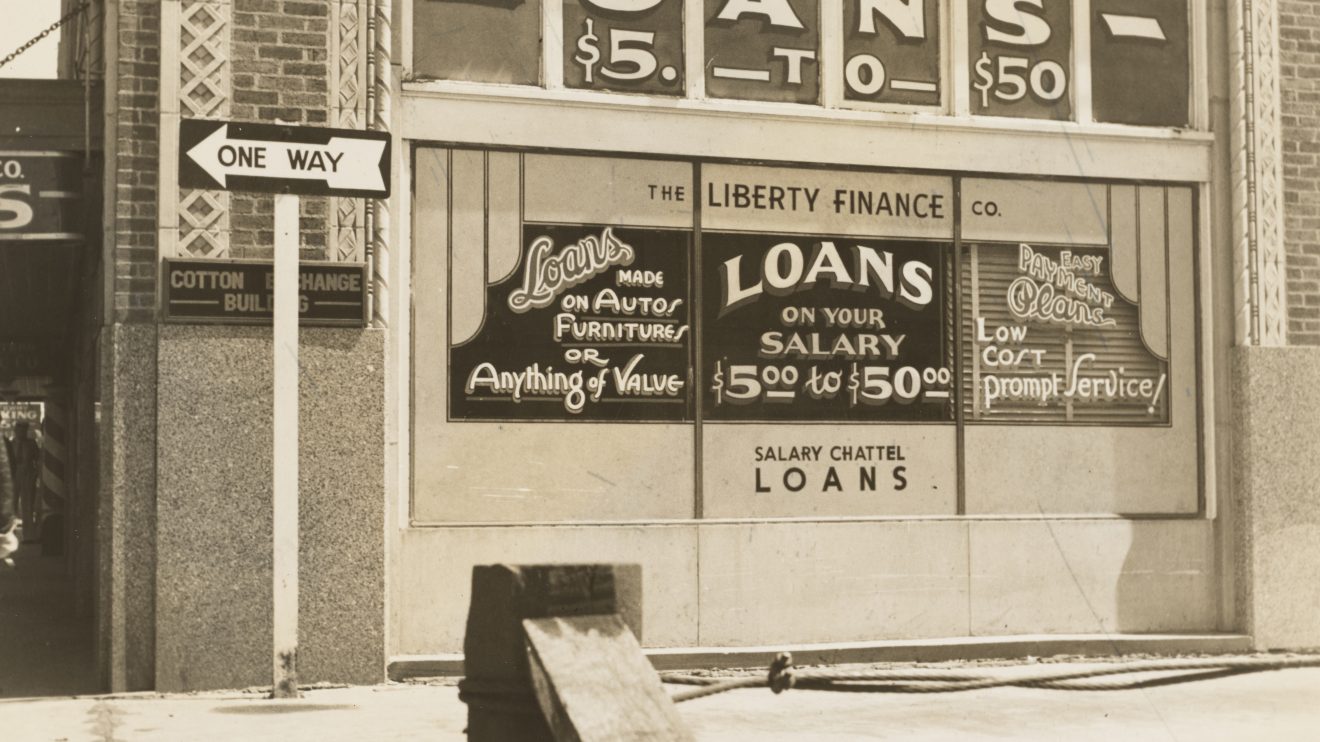

During 2020, the effects of the pandemic were especially notable for women-owned companies. Many women-owned business have been historically less-well financed when compared to men-owned firms.

“Lower financial indicators among female business owners are indicative of lacking service and attention provided by traditional financial institutions. This creates a financial opportunity gap among women who are running their own companies,” said Biz2Credit CEO Rohit Arora, who oversaw the study. “COVID-19 shed light on this trend by exacerbating a gender business funding gap that has long existed.”

The Biz2Credit analysis examined financial indicators. These included annual revenue, operating expenses, age of business, and personal credit score, of the loan applicant.

Key findings from the Biz2Credit Women-Owned Business Study:

Performance of women-owned businesses and their earnings

- Average Annual Revenue dropped from $384,359 in 2019 to $330,226 in 2020.

- The Average Earnings (annual revenue – operating expenses) of women-owned business grew to $181,770 in 2020. The average in 2019 was $107,804. The difference was largely because expenses decreased from $276,554 in 2019 to $148,455 in 2020.

- Average Credit Score for female business owners increased from 590 in 2019 to 597 in 2020.

- Top Industry: Services (except public administration) represented 26 percent of the women-owned companies in 2020.

- The percentage of business loan applications coming from women-owned firms decreased by 2 percent in 2020, compared to 2019.

Comparison of earnings of women-owned and men-owned companies

Biz2Credit compared male-owned and female-owned business health in its study, and the numbers underscore a larger problem. Women-owned firms are much less likely to apply for loans. On average, their companies’ earnings were less than half of the earnings of male-owned businesses. Their credit scores were lower too. Some specifics:

- Women-to-Men Borrowing Ratio: 27 percent female vs 72 percent male business loan applications according to Biz2Credit data in 2020.

- Average Annual Revenue Gap: women-owned businesses ($330,226) earned $421,928 less on average than male-owned firms ($716,842) in 2020.

- The 2020 Average Credit Score. On average the credit score for women-owned businesses (597) were 23 points lower than male-owned Businesses (620).

- Average Loan Size. For women-owned businesses, the average loan ($36,981) was 33 percent lower than the average loan for male-owned businesses ($55,061) in 2020.

- Average Age of Business. The average age of a woman-owned business was 5 years old. This was lower than the average age of a male-owned companies (6 years).

Industry

More than one-quarter (25.8 percent) of the women-owned companies that applied for business loans during the past 12 months have been in Services (except Public Administration). Retail accounted for 17 percent of the applicants, followed by Health Care and Social Assistance (9.5 percent), Accommodation and Food Services (9.2 percent), construction (6.2 percent), and Arts, Entertainment, and Recreation (5.5 percent).

Geography

Texas and California were the states that produced the most applications from women-owned companies, followed by Georgia, New York, North Carolina, Ohio, Pennsylvania, Michigan, Illinois, and Tennessee.

“The average funded amount for women-owned businesses ($39,731) was 36 percent less than the same for male-owned businesses ($61,958) in 2020,” added Arora, one of the nation’s leading experts in small business finance. “Upon thorough analysis, business-related factors, including lower FICO scores, younger age of business, and higher operating expenses played a more significant role in this gap, rather than gender alone. But there is a gender gap all the same.”

Paycheck Protection Program (PPP) Round 2: women-owned vs. male-owned businesses

In December 2020, Congress appropriated $284 billion for small business COVID relief for a second round of the Paycheck Protection Program (PPP). Biz2Credit examined its data from PPP loan applicants and discovered that 49 percent of the applicants for PPP Round 2 were women business owners (compared to all SBA lenders at 31 percent). The average approved amount for PPP Round 2 applicants who identified as women business owners on the Biz2Credit platform was $22,000, compared to $30,000 for those who identified as male business owners.

Jennifer Moore, a self-described “mom-preneur” credits the $20,000 PPP loan she got with Biz2Credit’s help as a “lifeline” that kept her home-based business, Stickers By Jennifer, going. The mother of two kids creates planner stickers that she usually sold at craft fairs and other events in and around Wayne, Michigan.

“I couldn’t make money locally, and COVID made it unsafe to travel, so I had to figure out how to run my business completely online,” Moore said. “When selling online, the key is speed. Customers want things quickly. I got new cutting machines; now I’m ready to cut and send out the same day by Amazon Prime.”

“PPP funding is betting on businesses like Ms. Moore’s that are putting in hard work, adapting to new market realities, and adopting creative solutions to overcome this pandemic. These loans are helping truly small businesses stay viable,” Arora said. “Biz2Credit is proud to be the nation’s leading provider of PPP loans in terms of the number of loans approved.”

Methodology

The 2021 Women-Owned Business Study’s dataset is composed of nearly 40,000 completed credit applications received via the Biz2Credit platform from January 2020 through December 2020. The four most important variables in the analysis were: annual revenue, operating expenses, age of business, and personal credit score. The data was then tabulated to examine women-owned and male-owned firms based on annual revenue, operating expenses, age of business, personal credit score, funding rate, and average loan size. The study looked at 20 different industries, as well as geography.

About Biz2Credit

Founded in 2007, Biz2Credit has arranged more than $3 billion in small business financing. The company is expanding its industry-leading technology in custom digital platform solutions for banks and other financial institutions, investors, and service providers.

Want to learn more about credit for your business and the importance of a credit score?

Add Comment