“Disaster Recovery Planning” sounds a little melodramatic but disasters come in many forms, but all can be terminal for an SME or starter business. A brief look at any newspaper will show that ‘disasters’ of one sort or another are more or less the norm nowadays. In any case for a business startup or any small business a ‘disaster’ doesn’t have to be very big to be very disastrous.

“Disaster Recovery Planning” sounds a little melodramatic but disasters come in many forms, but all can be terminal for an SME or starter business. A brief look at any newspaper will show that ‘disasters’ of one sort or another are more or less the norm nowadays. In any case for a business startup or any small business a ‘disaster’ doesn’t have to be very big to be very disastrous.

Normal Insurance, if you have it in place, will recompense you for physical damage or injuries, but unless you take out specific insurance it will not compensate you for the ‘Consequential Loss’ defined by Investopedia as

The amount of loss incurred as a result of being unable to use business property or equipment. If the property/equipment is damaged through a natural disaster or accident, only certain types of insurance can cover the owner for lost business income.

‘Direct Damages’ are covered under different types of insurance, such as property/casual or fire insurance, but when your business is shut down for days, weeks, or months while you struggle to get everything up and running again and all the time you are spending money and losing revenue.

Just sit at your desk and see just how little would have to ‘go missing’ to bring your business to a halt: your diary, your address book, your laptop, your server.

And what happens if you, or a key worker, go sick. Can your business still function?

And if you lose your data it may not even be possible to get ‘back to square one’ unless you have an effective Disaster Recovery Plan – ideally in a written form – in place. Even small mishaps can bring your business to a halt.

When you set up your new business you usually have little time and even less money to spare the assess the impact of critical incidents, let alone plan how to respond to, and recover from them. Yet it is essential that you have some sort of disaster recovery – sometimes known as business continuity – plan at hand.

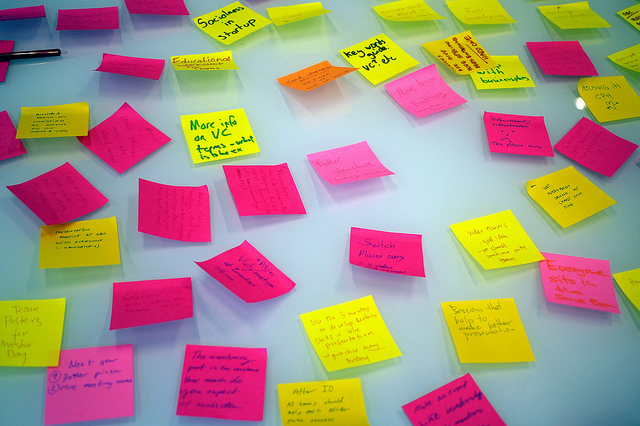

As a generality this plan needs two major axis:

Operational

- Can your business work if you’re incapacitated?

- Is there equipment without which your business would come to a halt?

- Which of your staff are key to the operability of your business?

and IT.

- Could one piece of equipment or location being unavailable mean loss or inaccessibility to your key data?

- Is there someone within your organization – other than you – who knows how to access your data?

This list is not meant to be exhaustive. Every business is unique and each will have its own list of risks. At the very least you should be defining the critical areas, people, equipment and data in your organization and protecting them.

Are you intending to launch your own business. Roger J. Webb’s wiki site New2Business.com site offers 250 pages of free suggestions and advice for the new Entrepreneur. And if you want to take your business on-line our Get On-Line pages can help you with that too.

Photo Courtesy of gunarsg [FLICKR]

Add Comment