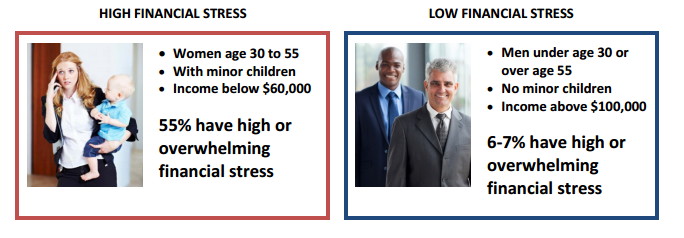

A new study reports that working mothers experience much more financial stress than anyone else. According to Financial Finesse, a financial coaching service, 55% of mothers between the ages of 30 and 55 who make under $60,000 report high or overwhelming financial stress. Men in the same demographic were more than twice as likely to report that they had no stress at all.

A new study reports that working mothers experience much more financial stress than anyone else. According to Financial Finesse, a financial coaching service, 55% of mothers between the ages of 30 and 55 who make under $60,000 report high or overwhelming financial stress. Men in the same demographic were more than twice as likely to report that they had no stress at all.

Across the board women reported higher levels of stress, no matter what their age or income. When Financial Finesse compared men and women, both with young children at home, men’s stress rates increased but not as drastically as that of women’s. Thirty-six percent of women with children reported high or overwhelming stress, where only 22% of men claim the same.

Financial Finesse develops unbiased financial wellness programs for the workplace. They do not sell products, but provide information and coaching to their clients. Kelley Long, a resident financial planner describes their programing, “We provide a variety of channels of financial education through workplace financial programs. We offer one-on-one meetings, a financial hotline that people can call, and we do workshops and webcasts. Our goal is to compel people to make just one positive change so that they feel more in control of their finances.”

According to their website 89% of employees do just that. Making one small improvement to an employee’s personal finances can have big repercussions. Employees who utilize financial education reduce healthcare costs for the company by 4.5% where non-users increase costs by 19.4%.

When it comes to retiring comfortably, financial education can make all the difference. 34% of users were on target to replace 80% of their income in retirement, after one year of education that number jumped to 47%.

Long explains how health care costs and retirement plans specifically affect women, “Because we are more likely to leave work to take care of ailing parents or children and because we live longer, we are likely to have to care for our spouses and then hire someone to take care of ourselves. For that reason alone women need to save 320k more than men and look into Long Term Care Insurance.

But also as we become more empowered, we take risks in our careers and try jobs that might not be as lucrative. Men are more engrained to go into a career, grow their income, and save money. Millennials take time off from their corporate job to teach yoga (for example) and that can cause them to take a hit to their financial plans. It’s not just saving money, but it’s also how much you are paying into social security. The better your income is then the more you pay into it, and the more secure your retirement will be.”

Cynthia Meyer, a resident financial planner and a member of the research team, had this positive message from the findings, “Women might be more likely to self identify as being stressed than men would, but perhaps they have their antennae up because of the children. Having children at home seems to be a bigger stress factor for women than for men. Women are more likely to feel like things are out of control, conversely when women have touches with a financial wellness program they make more progress and they feel better. When women take matters into their own hands, they make small changes in their daily life, they can reduce their overall financial stress and develop a system of equanimity and balance.”

By tracking questions asked to the hotline, Financial Finesse found that healthcare was a big issue for many people. Meyer explains, “In the employee benefits place, there have been many changes in how healthcare is offered to employees. It’s common for employees to offer a high deductible in conjunction with a health savings account which can be very beneficial but it’s complex. You have to learn more information and make more choices about health care options. The complexity adds distress and people get decision fatigue. They are trying to decide what’s the best option for their family, but how do they understand all these different terms and jargon? That has definitely contributed to maintaining overall fairly high levels of stress even though the economy has improved.”

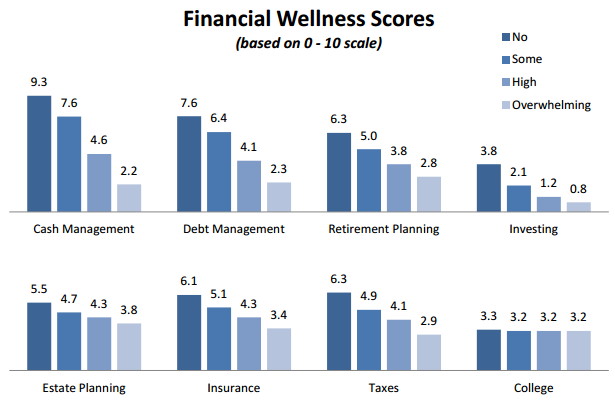

The report also ranked people’s Financial Wellness on a scale of 1-10, where 9.0 or above meant, “Employees have excellent financial skills and habits…” and 3.0 or below meant, “Employees are in dire need of guidance around basic personal financial skills.”

The report also ranked people’s Financial Wellness on a scale of 1-10, where 9.0 or above meant, “Employees have excellent financial skills and habits…” and 3.0 or below meant, “Employees are in dire need of guidance around basic personal financial skills.”

Meyers observed, “What was interesting to me was that people with overwhelming financial stress also had very low wellness scores particularly in the areas of debt and cash management, retirement planning and investing. Investing was 0.8 out of 10, cash management 2.2, and retirement planning was under 3. Those were the lowest financial wellness scores overall.

It’s important because there are cascading financial effects for these people. For example, they don’t have an emergency fund. If they are hit with an unexpected bill, their car breaks down, or there is some kind of financial emergency that requires unexpected spending, they put it on the credit card but they can’t pay it all at once, so they’re paying 22% interest. Then the credit card bill gets bigger and maybe another emergency comes up and it gets a little bigger. The debt gets bigger, and people aren’t finding resources to pay down the minimum balance so they don’t make time to contribute to their retirement plan, not even to get the maximum match. Not having a small emergency fund has a cascading effect on your whole financial life and it leads to these very low financial wellness scores.”

She goes on to explain, “When we talk to women we talk about things like taking a career break, caring for older parents, and financial self defense. We help women to understand their financial choices and decisions.”

While women might be more willing to admit that they are stressed, they are also more likely to benefit from financial classes and coaching. According to Financial Finesse’s data two-thirds of their users were women and they are learning how small changes can build financial security, such as building an emergency fund, tracking expenses, paying down high-interest debt, and taking advantage of employee-sponsored benefits.

Rachel Rojas is a freelance writer out of Springfield, Massachusetts. She writes local interest stories for The Westfield News, business articles for Lioness Magazine, and dabbles in short novels in between assignments. Despite the fact that she loves all things intellectual, she has a soft spot for trashy romance novels and pretty clothes.

Rachel Rojas is a freelance writer out of Springfield, Massachusetts. She writes local interest stories for The Westfield News, business articles for Lioness Magazine, and dabbles in short novels in between assignments. Despite the fact that she loves all things intellectual, she has a soft spot for trashy romance novels and pretty clothes.

Add Comment